Chip-supply lead times stretch to a record 17 weeks

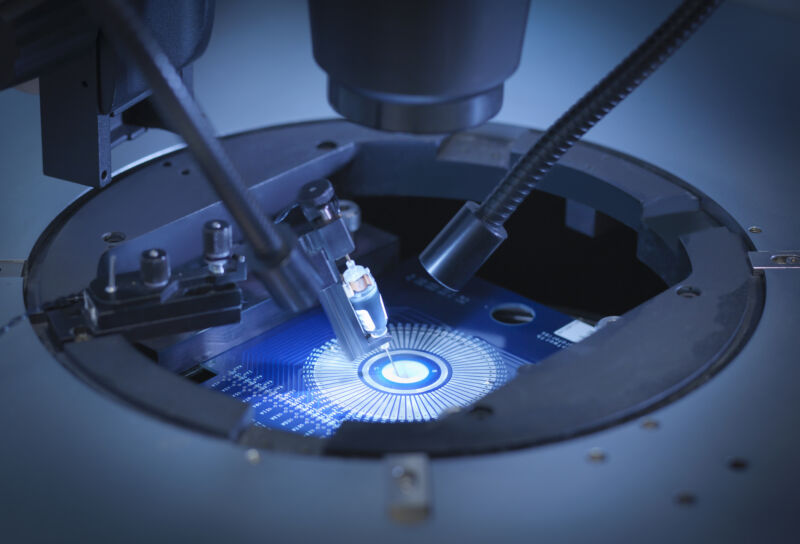

Enlarge / This machine is checking silicon wafers in a cleanroom lab—class 1 chip facilities must limit dust to 10 particles per cubic meter, 1/1000th the amount found in hospital operating theaters. (credit: Monty Rakusen via Getty Images)

Susquehanna Financial Group analyst Chris Rolland noted Tuesday that the wait time for all major semiconductor product categories is up considerably—from 16 weeks in March to 17 weeks in April. This represents the longest lead time—the elapsed time between placing an order and receiving products—that the industry has faced since 2017, when the firm began tracking this data.

Rolland called this elevated lead time a "danger zone," noting further that "elevated lead times often compel bad behavior [from] customers, including inventory accumulation, safety stock building, and double ordering." In other words, major companies seeking VLSICs don't behave very differently from consumers seeking toilet paper.

These shortages impact nearly all industries to some degree, with the heaviest impact tending to fall on industries with long lead times of their own—in particular, the automotive industry is projecting $110 billion in lost sales this year due to factories sitting idle, waiting for components. Again mimicking last year's toilet paper shortages, hoarding tends to make the gaps worse—as the lead times get longer, buyers become more likely to overorder and make supply chain problems worse.

Read 3 remaining paragraphs | Comments

from Tech – Ars Technica https://ift.tt/3fq1UGY

Comments

Post a Comment